TRANSACTIONS

We have a track record of achieving valuation multiples well in excess of industry norms

Year: 2025

Sector: Industrials

Terms: Not disclosed

CHM Group is Ireland’s leading provider of traffic management solutions. Established in 2001, the company has played a key role in the evolution of temporary traffic management in Ireland, offering innovative solutions and comprehensive expertise to public and private sector clients.

Year: 2025

Sector: Business Services

Terms: Not disclosed

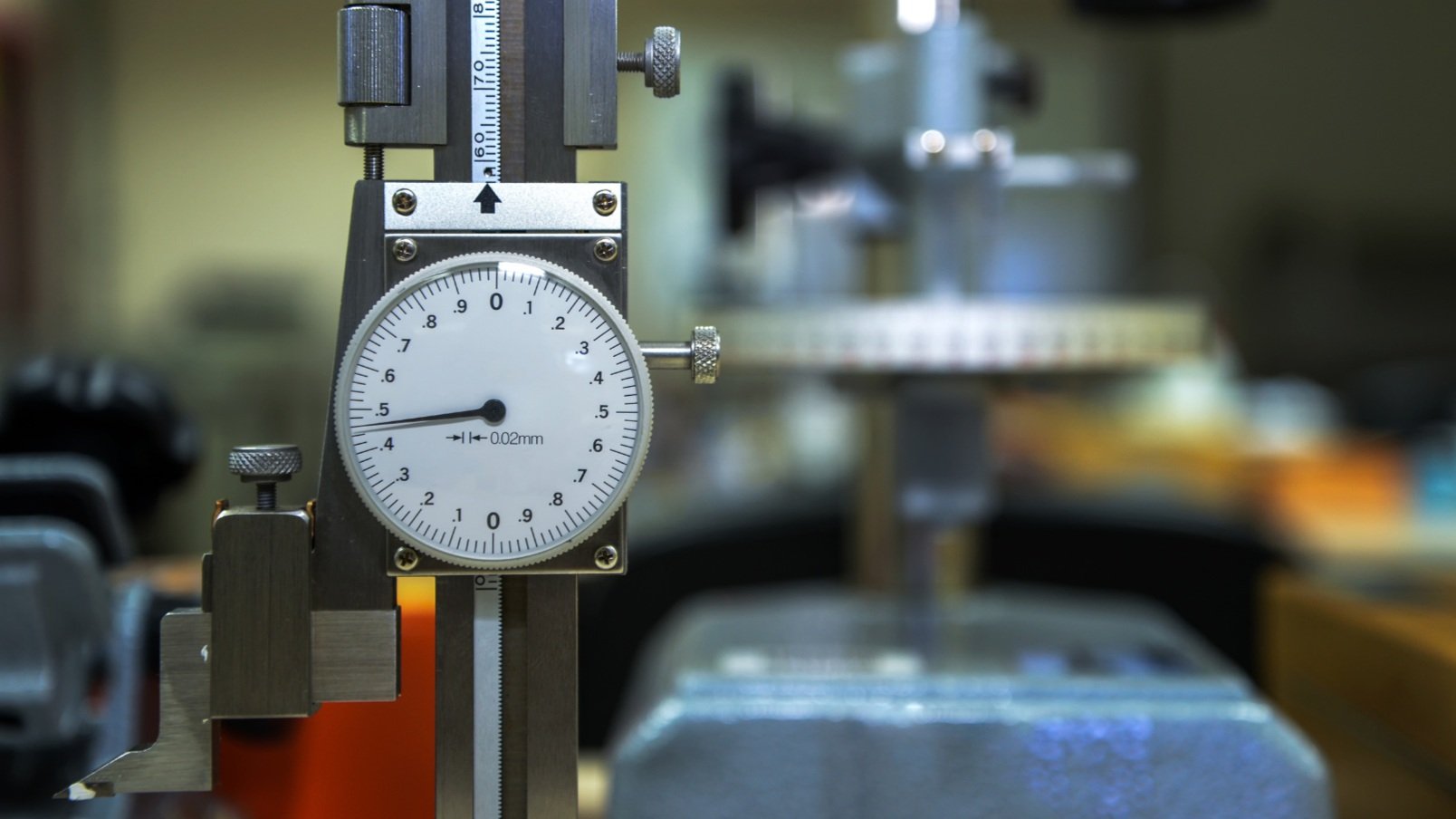

Multiplex Engineering is a leading supplier of calibration services and products in Ireland, with strong positions in the food, beverage, pharmaceutical, and power sectors. The company is recognised for its on-site calibration expertise, comprehensive product portfolio, and bespoke solutions that meet the precise needs of its clients.

Year: 2025

Sector: Software

Terms: Not disclosed

Net Affinity is a leading provider of software and marketing services for the hospitality sector. Founded in 2000 and based in Dublin, the company specialises in direct booking solutions, serving over 400 independent and group hotels across Ireland and the UK. Net Affinity’s platform integrates booking engines, marketing tools, and connectivity solutions, enabling its clients to optimise revenue generation and improve guest experiences.

Year: 2024

Sector: Business Services

Terms: Not disclosed

FDT is a specialist consultancy, with a process engineering emphasis. The Company has strong competencies across production design, water and energy reduction, and aims to make its clients more competitive through efficient capital spend, optimised processes, and success in meeting compliance requirements. FDT’s offerings cover a range of technical and specialist solutions including concept design, capital cost estimates, detailed process and utilities design, installation management, energisation and commissioning of plants, HAZOP studies, and ATEX compliance reports.

Year: 2023

Sector: Manufacturing

Terms: Not disclosed

Multihog Limited is focused on the design and manufacture of compact multi-purpose tractors, particularly for municipal, airport and commercial use. The range of applications for its product range includes street sweeping, snow clearing, hedgerow cutting, mowing and surface cleaning. The Company exports to c. 30 countries and will launch an electric powered model in 2024.

Year: 2023

Sector: Software

Terms: Not disclosed

Alkimii Limited has developed a software platform focused on serving the needs of hotel operators in terms of managing their labour and property costs.

Its clients include Dalata, the largest hotel chain in Ireland, as well as a number of other hotel groups and independent operators. It has a leading position in Ireland and is increasingly focused on expansion in the UK and US markets.

Year: 2023

Sector: Business Services

Terms: Not disclosed

Pegasus Capital advised John Spain Associates Limited (“JSA”) in its sale to ORS Limited (“ORS”), a company backed by Irish private equity fund, Erisbeg.

JSA is one of Ireland’s leading planning consultancies, with extensive experience of the country’s planning systems.

The integration of JSA’s expertise into ORS will significantly bolster its capacity to deliver comprehensive and innovative solutions across the planning and construction domains.

Year: 2023

Sector: Technology

Terms: Not disclosed

Pegasus Capital advised Zevo Health on its investment received from ScaleUp Capital. Zevo is a market-leading workplace wellbeing provider and has earned a strong reputation for providing best in class psychological support to content moderation teams in some of the most recognised global companies.

ScaleUp Capital is a London-based growth equity investor focused on partnering with B2B businesses with a technology, software, content or services angle.

Year: 2023

Sector: Technology

Terms: Not disclosed

Pegasus Capital advised Rainmaker Business Technologies on its sale to strategic acquirer, Skymetrix GmbH. Rainmaker’s software platform enables airlines better understand and manage their operating performance and related costs.

Skymetrix offers airlines a cloud-based software platform that enables its customers to control their direct operating costs in areas such as fuel, airport, navigation and ground handling.

Year:2023

Sector: Technology

Terms: USD 13,000,000

NewsWhip Media Limited (“NewsWhip”) has developed a SaaS platform focused on predictive media monitoring. Its clients include leading global brands such as Google, The New York Times, Samsung and the BBC.

The company wished to raise primary capital to fund the expansion of the business across a number of areas, including sales, marketing and product, which is expected to lead to 50% growth in its current headcount of 71 employees over the next two years.

Year:2023

Sector: Financial Services

Terms: Not disclosed

Pegasus Capital has advised Twomey Moran & Partners Limited on its sale to PwC.

Twomey Moran & Partners Limited is one of Ireland’s largest independent advisors on tax matters working with leading private businesses, families and high-net-worth individuals

As the largest professional services firm in Ireland, PwC offers a broad range of services across audit, tax and advisory.

Year: 2022

Sector: Financial Services

Terms: Not disclosed

Pegasus Capital has advised Sparrow Insurances Limited on its sale to Aston Lark Ireland.

Sparrow Insurances Limited is an Irish insurance brokerage offering a full range of commercial and personal insurance products as well as life, pensions and investment products. It is headquartered in Portlaoise with offices in Dublin, Nenagh and Thurles.

Aston Lark Ireland is a rapidly growing insurance broker that recently became part of the Howden Broking Group.

Year: 2021

Sector: Technology

Terms: Not disclosed

BearingPoint Technology GmbH (“Beyond Now”) is the Austrian-based telecommunications software business formerly owned by BearingPoint Holding BV, a leading global business consultancy.

Its Infonova software solution is a Software-As-A-Service (“SAAS”) platform that enables telecommunications companies to better monetise their customers.

Under its new ownership, the business was re-banded as Beyond Now in early 2022

Year: 2020

Sector: Healthcare

Terms: Not disclosed

DCN Diagnostics, Inc. (“DCN Dx”) is a leading specialist developer of lateral flow technology. Based in Carlsbad, CA, it offers a full suite of consulting, design, development and manufacturing solutions to clients seeking to develop lateral flow assays, mainly for diagnostics applications.

DCN Dx’s CDMO services cover all stages of the creation of a new lateral flow assay, including: (i) education courses, (ii) assay and test strip conceptualisation and feasibility analysis, (iii) product regulatory path guidance, (iv) prototyping and development, (v) assay optimisation and verification, and (vi) gap and full manufacturing.

Year:2021

Sector: Technology

Terms: USD 64,000,000

Pegasus Capital has advised Betapond Limited T/A StitcherAds on its sale to US company Kargo Global Inc.

StitcherAds is a leading paid social advertising platform empowering advertisers and agencies to scale full-funnel performance marketing campaigns on Facebook, Instagram, Snapchat, Pinterest, and TikTok.

Kargo Global Inc. is the leader in creating mobile advertising experiences that elevate brands and motivate customers.

Year: 2021

Sector: Technology

Terms: EUR 45,000,000

Pegasus Capital has advised AdaptiveMobile Security on its sale to Swedish listed software company Enea. The acquisition of Adaptive represents a significant expansion of Enea’s telecoms network security and 5G capability. Adaptive is a leading global player in signalling and messaging security with tier 1 communications customers including AT&T, Twilio, and T Mobile.

Enea is one of the world’s leading specialists in software for telecommunications and cybersecurity. Its cloud-native products are used to enable services for mobile subscribers, enterprise customers, and the Internet of Things.

Year:2021

Sector: Financial Services

Terms: Not disclosed

Pegasus Capital advised the shareholders of Harvest Financial Services Limited and Harvest Trustees Limited on the sale of both companies to Irish Life Group.

Harvest is one of Ireland’s leading financial advisory firms overseeing in excess of €1bn in assets on behalf of its clients which include pension funds, private individuals, corporations and charities. Irish Life is one of Ireland’s largest financial institutions and is owned by Great-West Lifeco, a Canadian headquartered global insurance group with over 20,000 employees.

Year 2021

Sector: Food & Drink

Terms: Not disclosed

Pegasus Capital has advised Carroll Cuisine UC (“Carroll Cuisine”) on the sale of the business to Eight Fifty Food Group Ltd., a portfolio company of CapVest Partners.

Previously owned by Carlyle Cardinal Ireland, Carroll Cuisine is the no. 1 player in the sliced cooked ham and ready meals segments of the Irish chilled food sector. Eight Fifty Food Group Ltd. has an existing portfolio of complementary meat and fish business and is a strong strategic fit for Carroll Cuisine.

Year: 2021

Sector: Technology

Terms: USD 56,000,000

LearnUpon Ltd. is a cloud-based, SaaS platform, that enables organisations to manage and track learning goals across employee development, customer onboarding and more.

Organisations can use LearnUpon’s LMS platform to manage, track and achieve learning goals, as well as employee development, customer onboarding, partner education and compliance training.

The Summit Partners funding will be used to boost hiring, meet customer demand and support the continued roll-out of its products.

Year: 2020

Sector: Healthcare

Terms: Not disclosed

Pegasus Capital has advised Insight Acquisition Holdings Ltd. (“IdentiGEN”) on the sale of the business to Merck Animal Health, a division of Merck & Co., Inc. Dublin-based IdentiGEN is a global leader in DNA-based animal traceability solutions for livestock and aquaculture. Its DNA TraceBack® solution enables beef, pork, poultry and seafood products to be reliably traced through the food supply chain.

The acquisition of IdentiGEN will enable Merck Animal Health to provide end-to-end animal traceability solutions.

Year: 2020

Sector: Financial Services

Terms: Not disclosed

Pegasus Capital has advised the shareholders of Conexim Advisors Ltd on the sale of the company toIrish Life Group. Conexim provides services to accountancy firms, pensioner trustees and financial advisors who themselves are involved in providing financial and investment advice to both individuals and corporate clients.

Over 200 regulated entities use the independent platform, which currently has €1bn of assets under its instruction.

Year: 2019

Sector: Consumer & Food

Terms: Not disclosed

Pegasus Capital has advised Kepcar Investments Ltd. on the sale of Greene Farm Fine Foods Ltd. (“Greene Farm Fine Foods”) to O’Brien Fine Foods UC, the parent company of Brady Family Ham.

Greene Farm Fine Foods’ products are the finest quality; its full range is hand prepared using natural ingredients. It operates from a 50,000 sq.ft. state-of-the-art production facility in Rathowen, Co. Westmeath and has in excess of 100 employees.

Year: 2020

Sector: Software & TMT

Terms: Not disclosed

Roomex Ltd. is an accommodation management platform for corporates. It enables corporates control costs, secure superior accommodation rates, ensure corporate travel policy is adhered to, and monitor and account for employee accommodation expenditure in an administratively straightforward manner.

The funding round was led by Draper Esprit Plc. with co-investment from other investors in order to help fund the growth of the business.

Year: 2019

Sector: Healthcare

Terms: Not Disclosed

Pegasus Capital has advised Arrotek Medical Ltd. (“Arrotek Medical”) on its sale to Theragenics Corp. Arrotek Medical is a specialist contract development and manufacturing organisation (“CDMO”) based in Collooney, Co. Sligo.

US based Theragenics Corp. is a global supplier of access and procedure medical devices for a range of interventional and endovascular procedures, and is backed by private equity fund Juniper Investments.

Year: 2019

Sector: Financial Services

Terms: Not Disclosed

Pegasus Capital has advised one of Ireland’s largest independent insurance brokers, Murray & Spelman group, on the sale of the business to Arachas Corporate Brokers Ltd.

The Murray & Spelman and Arachas businesses are highly complimentary with similar cultures and values and the acquisition will strengthen Arachas’ position in Murray & Spelman’s core markets in the West of Ireland and Kildare.

Year: 2019

Sector: Healthcare

Terms: Not Disclosed

Pegasus Capital has advised Epona Biotech Ltd. on the transfer of its Stablelab diagnostic blood test to Zoetis Inc., the world’s leading animal health company.

. Zoetis Inc. will manufacture, market and distribute Stablelab, thereby immediately giving the test significantly increased global coverage in the equine health market.

Year: 2019

Sector: Software & TMT

Terms: Not Disclosed

Pegasus has advised VideoElephant Ltd. on a $6m growth funding round led by ACT Venture Capital. The funding raised by VideoElephant will enable the company expand its content library and accelerate its go-to-market strategy.

The investment round was led by ACT Venture capital, with co-investment from a number of new investors and existing shareholders. Pegasus has advised VideoElephant on all fundraisings since its Series A round.

Year: 2018

Sector: Consumer & Food

Terms: Not Disclosed

Pegasus Capital advised Kepak on its acquisition of the red meat business of 2 Sisters Food Group from Boparan Holdings Ltd.

The acquired business is one of the largest primary meat producers in the UK processing 250,000 cattle and in excess of 1 million lambs from four production facilities in England, Scotland and Wales.

Year: 2018

Sector: Healthcare

Terms: Not Disclosed

Pegasus Capital advised Neurent Medical Ltd. (“Neurent Medical”) on a EUR 9.3 million venture capital fundraising led by Fountain Healthcare Partners and Atlantic Bridge Capital.

Led by founders Brian Shields and David Townley, Neurent Medical is developing a device for the treatment of rhinitis, an inflammatory disease of the nose.

Year: 2021

Sector: Healthcare

Terms: Not disclosed

Based in Grand Rapids, MI, Empirical Bioscience Inc. (“Empirical Bioscience”) offers molecular biology solutions, including custom assay development, CDMO services, and the contract development of speciality enzymes.

Its core offering includes: (i) the supply of custom enzymes and mastermix, (ii) manufacturing of proprietary enzymes, (iii) the supply of private label assay kits, and (iv) the supply CLIA laboratory reagents.

View